The checkout process is one of the most frustrating parts of online shopping for a customer. Think back to your own shopping experience: whether you’re buying a new pair of shoes or a new jacket, all of the excitement can be easily tarnished by a glitchy website. And it gets even worse when you have to deal with five or more pages of checks and questions that don’t seem to add up to anything.

To avoid the stress of trying to understand why your checkout is slow, and to help you reach your sales goals, we’ve gathered tips from experts on how to speed up the checkout process for your customers. Here are three tips on how to accomplish that and make sure you’re leading them to click “Yes” to your offers.

1. Simplify the Checkout Process

The faster your customer can check out, the faster your business makes sales. It’s that simple.

A recent study found that the average online purchase takes just two minutes and 31 seconds to complete. Furthermore, the study found that the least experienced customers –who are likely to be reading a lot of reviews before making a purchase –take just as long as the most experienced customers – who are likely to be more familiar with the product or service to finish their shopping journey.

To maximise every sale opportunity, simplify your checkout process. At checkout, you want to focus on promoting reasons for conversion, while avoiding any distractions from purchase. Let your customers know exactly how much they’ll be saving compared to what they normally pay, and offer them additional incentives to use your website (like free shipping or a freebie).

Simplify the checkout experience by bringing the number of redirects, the amount of information you’re asking and the overall number of clicks they need to make to a minimum. Reduce the number of forms, remove the mandatory registration before purchase and automate as much as possible. For example, you can add a checkbox that auto-populates the address from shipping to billing and vice-versa (“Shipping address same as billing address”). You can also save and auto-fill customers’ information to save them time.

2. Make it Fast

The checkout page is the most likely place to lose sales. Depending on the industry, the average shopping cart abandonment rate at the checkout page ranges from 65% to 96%.

So, the easier you can make it for your customers to get from A to B, the faster it is for you to make sales.

The more steps you have in your checkout process, the more times a customer has to make a decision about whether they want to spend with you.

To combat cart abandonment, optimize your site as much as possible, test it, and don’t forget about international traffic. This includes language, currency, shipping and, of course, payment options. Why? Because over 40% of European shoppers refuse to purchase something online if the website isn’t translated into their language. Don’t lose this opportunity to make a sale!

3. Look After Your Customers’ Encryption Data

Your customers’ data is valuable, and many businesses risk losing a lot of money if it gets stolen. Therefore, data security is one of the biggest concerns for consumers when they think about shopping online, and with good reason. According to a study by American Express, more than $19 billion worth of customer data was stolen in 2018. And the problem is getting worse. In 2019, a data breach at Target led to the theft of personally identifiable information of millions of customers.

To protect yourself, its highly recommended to offer users two-factor authentication, which adds an extra layer of security to their data.

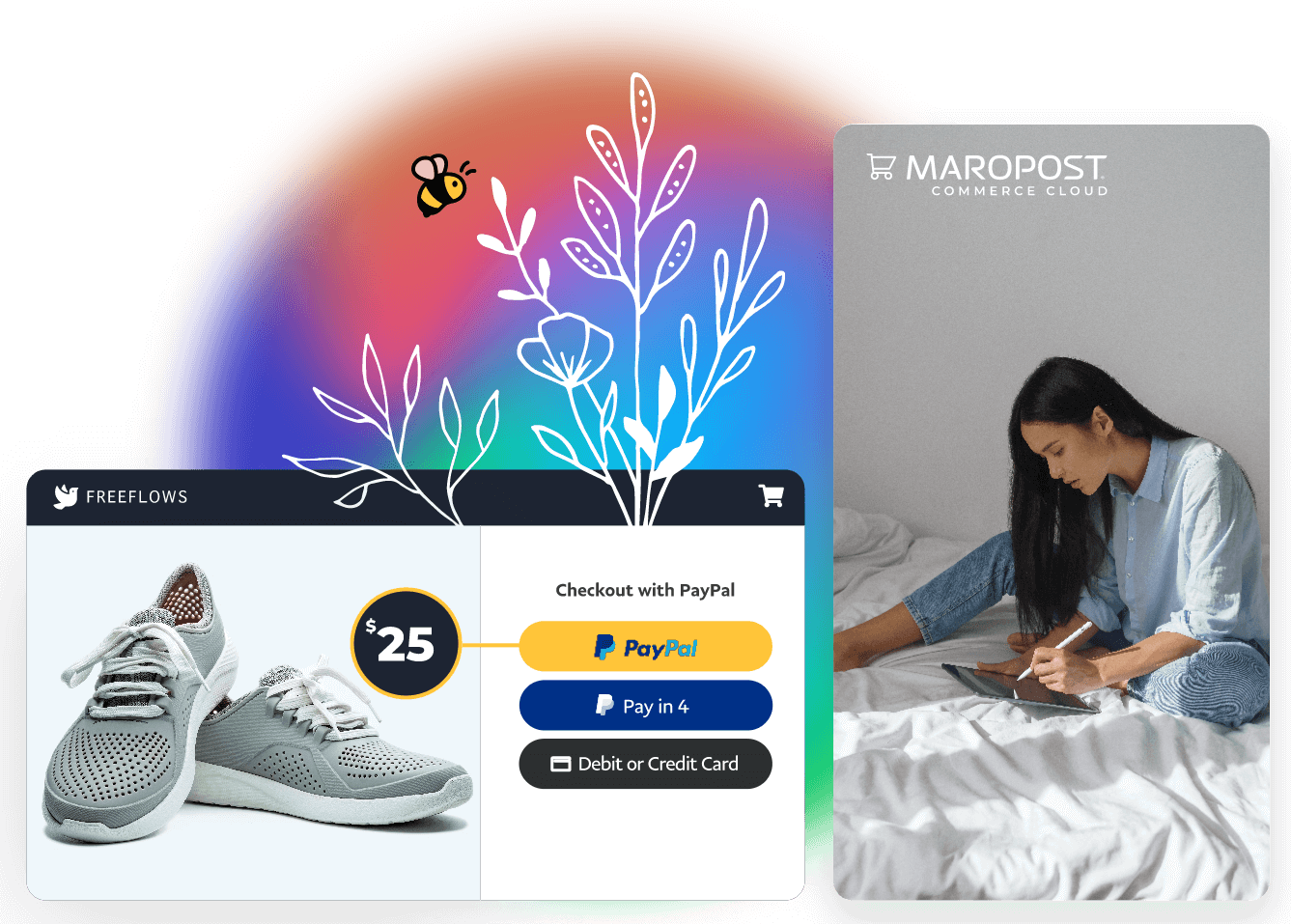

Maropost has extended its integration with PayPal, a payment provider that offers various ways to shop, check out and pay securely. In fact, many Buy Now Pay Later customers prefer to use Pay Later by PayPal specifically due to the trust and peace of mind that PayPal provides. 1

Of course, when you’re focused on removing unnecessary steps and speeding up that checkout process, it’s easy to overlook some important features. With our PayPal integration, you can get a simple and quick checkout getaway with a variety of options, features and convenience all in one.

Learn more about PayPal’s Pay Later solution, PayPal Pay in 4 which is now available on the Maropost ecommerce platform here and streamline the checkout flow for your customers today!

1.PayPal is the most trusted brand across BNPL payment providers. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

Need to chat about your mobile marketing strategy?

More than 10,000 marketers use Maropost to engage with their prospects and customers through emails, SMS, social media and more. We’re here to help you grow your business!

Chat Now